Current Job Postings

Connectivity

Connectivity

A wise mouse once repeatedly said that “It’s a small world after all”. Little did this wise mouse know the truth this statement would grow into. In the time that the song “It’s a Small World After All”, was written, the world was a very different place. People performed strange rituals of writing emails on paper and having a person manually deliver them by hand, while phones couldn’t as much as leave a room much less be carried around in our pocket. Even the idea of a cloud network was little more than a weather forecast.

With the technology we have today, you could be sitting at your desk, you can receive, read, edit, and send reports instantly, without even being in the same country. The internet has become a pandora’s box of opportunity, thanks to these advancements. a single key that can open a limitless amount of doors. Behind one such door, leads to new and exciting possibilities via a process known as outsourcing. Not only is this technology bringing together a single expanded company, it’s uniting multiple companies. This is all a part of outsourcing.

Outsource: Verb: obtain (goods or a service) from an outside or foreign supplier, especially in place of an internal source.

Outsourcing can be almost anything, including advertising, design, even labor. Vision H.R, the outsource company that we will be focusing on, specializes in payroll services, and human resource management.

Using the technology we talked about earlier, a company like the Daytona Beach payroll company Vision H.R. can work with a range of clients across Volusia County and Central Florida, all from one central location. Working through digital mediums, Vision H.R. can supply their clients with detailed reports, both general and broken down by department or division, 24/7 online employment information, and an online HR support center, without the need to be physically present. Of course, there are options to have someone there in person to aid you if the situation calls for it.

With businesses such as outsourced payroll management incorporating such technologies into their everyday routine, it seems that the future no longer has a connotation of being years away, instead the future seems like it is just around the corner. We are in an age where tomorrow can literally bring a new, life changing technology, and with each new advancement, companies like Vision H.R. are better able to serve their clients.

Daytona Beach Payroll Company

Vision HR | The Human Resource Experts

Human Resources: Ins and Outs

Human Resources: Ins and Outs

No great battle was ever won by people running around in circles, wondering where to go. Can you imagine how long the American Revolution would have lasted if the minutemen and the redcoats both had no idea what they were supposed to do? No General to keep them organized? We would have had two armies running around hoping they eventually bumped into each other. Sounds more like a Monty Python skit than anything else. The only positive schedule that would be followed is when to stop for lunch. Overall we can see why this method would not work out all too well. A business is no different. In the landscape of both the business and the digital world, it many times turns to human resource departments to help maintain organization in the work place.

But what exactly does a human resource department actually do? This is the important question that not everyone can always answer, or at least answer completely. In some ways the human resource department can seem like the underappreciated arm of a business. Typically an employee will only know enough that they don’t want to be sent to the human resources department, putting it on par with being sent to the principal’s office back in elementary school. So what all responsibility can fall upon a human resource department? For that answer, we will turn to Vision H.R. and take a look at the services they offer with their Human Resource Management packages.

Human Resource Compliance: The only thing in this world that is certain not to change, is the fact that the world is always changing. This doesn’t mean the changes are always going to be something major, they can be as simple as a an amendment to an employment law. As simple as that may sound, it could have negative effects on your business if you don’t keep track of it. This is why Human Resource departments have to stay current on changes in the laws and regulations, so they can implement these changes in the business, while also keeping employees and management informed of them as needed

Employee Communication: The easiest way to break the rules is to not know what they are. Common sense can usually get an employee a long way, but there are somethings that good sense cannot tell an employee about the work place. This is where items like an Employee Handbook come in handy. With an employee handbook, and a signed agreement to follow the procedures found within, an employee will be better suited to perform their job. It is also good to look back on in case an employee forgets. When you have memorized every lyric to every Journey song, your memory can tend to slip in other areas. An Employee Handbook can remedy this issue.

Management Training: What good is a store without management? Much like the analogy of armies without structure or Generals, a store without managers is a store without direction. A store with untrained managers is just another level of people not knowing what to do or where to be. Human resource experts are here to help train managers in various areas, making sure they can perform their duties effectively. The areas included in management training can include:

• Hiring Employees

• Terminating Employees

• Dealing with Discrimination and Sexual Harassment

• Progressive Discipline

• Customer Service

• Diversity

This can be in different ways, including online, training facilities, and even on location.

Progressive Discipline: Sometimes employees can get off track, and need a little help focusing. This is where progressive discipline comes in. With progressive discipline, an issue in the workplace can be fixed before it escalates any further. Much like a broken hammer, you can buy a new handle and keep on working, or ignore it and when the head flies off mid swing, hope whoever is behind you has quick reflexes. If you fix the hammer and it continues to break, it may be better to replace the whole hammer instead of trying to fix it.

Background Checks and Drug Screenings: Labor is never free, you are putting trust and money into someone, usually a stranger, to perform work for you. Until you have worked with them enough to really judge their character, background and drug screenings can give you a more in depth look at potential candidates for hiring. Background checks can look into previous employment history and criminal records. You don’t want someone with a background of stealing and dishonesty in the workplace running a cash register filled with money do you? Of course you don’t. That would just be poor judgement on your part.

Human Resource Support: One of the most important things that a human resource department must be is be available to help at all times. Problems are not going to check your schedule and ask when a good time to show up is. They can pop in just as suddenly, and cause just as much damage as, the Kool-Aid man bursting through a living room wall. This is why it is best to have a human resource department that is available at all hours of operation.

That is quite a bit of responsibility to cover, and there is still more we could add to it. It could be a bit difficult to try and train someone new to fulfill the position. When you outsource your Human Resource responsibilities to a company like Vision H.R., who already handle Oak Hill to Lake Mary, and upwards to Ormond Beach Human Resource management services, you get a dependable human resource department with a support team always ready to assist you.

Ormond Beach Human Resource Management

Vision HR | The Human Resource Experts

The Path of Prosperity

The following article was written by a guest writer for Vision H.R.

The Path of Prosperity

I remember, if you would humor me a bit by listening to me reminisce on my own past experiences, a time when I worked in the grocery store in a small town nestled in the lower part of Tennessee. The town was little more to the world than an exit with gas stations and hotels for the wandering traveler. I shared its spirit well, being little more than another employee to the grocery gathering customers that came through our doors. I got a raise now and then, a promotion or two, yet they hardly accelerated my path toward any of the goals I had. I remember one day in the latter part of May, it was just after sundown, the traffic in the store was fading out, and I was on aisle 5 stacking soup cans, that I decided I was not making the right choices to reach my goals. It was that day I made a plan, a promise, and a change in direction. I spent the better part of the year still working there until finally tax season came around. Taking what funds I had saved up, and what funds I got back from my taxes, I packed my little PT Cruiser, and I headed south to a new land of consequences and opportunities.

How did my little venture pan out? In my short time here, I went from a pizza delivery boy, finding my footing in a strange land to being the one behind these words that you are reading today, standing in an office building walking distance from the golden sands of Daytona Beach FL. It would be suffice to say that I’ve done well, yet I still have miles left to go.

Much like my own little personal story of success, others have followed similar paths. Believe it or not, some of the most wealthy men and women of the modern age started with nothing or at most next to nothing. Each of them followed their own path, yet the foundation for them all was the same. They had a goal, and they had a plan to reach it. This is not to say they made it all on their own either. I had family here in Florida, who helped me get started once I arrived here. Without their help, my future here would have been uncertain. This is perhaps the most important lesson that I want you to take from this tale, that I did not do this alone.

Did I ever feel overwhelmed when I moved here? I can hardly be modest about how stressed I felt at times. These were the times, having help were vital to my journey. When you operate a business, it is a simple affair to take on more than you are able to handle. You have never had to run a business before, much less start one, how would you know what you can handle? Applause to you for doing your best, but maybe it’s time you too accepted that you could use a helping hand. Fortunately that helping hand is always available to you.

There are companies that focus purely on being that helping hand to companies in need. They take on the burden of responsibilities such as performing payroll services, human resources; even have options for helping with areas like hiring, management training, and connecting you with insurance companies to protect your business. You could hire someone to work these areas in house, but if you are stressed about handling them yourself, how do you know you can properly train someone else to handle them? Not to mention, it will cost you to pay that person to handle your payroll or human resource needs. Before you spend the time and money on that, let’s explore an alternative route on the path to prosperity. Mainly, the type of companies that we spoke of earlier.

In business terms, the act of giving these responsibilities over to another company is known as outsourcing. When you outsource a department such as your human resource management, you are bringing on a business partner in the form of another company. You will get access to information and assistance on anything you need to know. You just have to supply the revenue to pay the employees and the company for their services. One great benefit of this is as your business grows, so will your needs. Outsource companies like Vision H.R. are prepared for your company to expand, whereas in house may require you to hire more employees to work in your human resource department.

How do you know companies like Vision H.R. can be trusted with your payroll and human resource management? Because they don’t prosper if you don’t prosper, their success is directly tied to the success of their clients. As a team, when your company succeeds, everyone helping it succeeds as well. So take a step up on the ladder to prosperity, and look at outsourcing options today. From Melbourne to Palm Coast HR Services, Vision H.R. has the resources you need.

Palm Coast HR Services

Vision HR | The Human Resource Experts

What if your employees discuss wages with each other?

Q. Recently some of my employees were given a pay raise. It was not an across-the-board increase. One of my employees, who tends to be a troublemaker anyway, starting discussing his wage increase with other staff members and causing them to be dissatisfied with their raises. We have a policy prohibiting employees from discussing their pay with each other. Can we fire this troublemaker for violating our policy?

A. Sorry, but a “go-ahead” to terminate this employee could get your business into serious trouble.

Some employers feel this is one of the greatest employee-induced irritations there is to deal with and they yearn to exile the employee. But under labor laws, and court decisions based on these laws and public policy, it is an unfair labor practice to discipline or dismiss an employee for discussing wage levels and the increases with other employees.

The bottom line is, your employees have the protected right to join together in discussions and activities in an effort to promote their mutual welfare. And you, the employer, must not interfere with or threaten employees for using this right.

Continue reading..

How Long do you Have to Retain Payroll Records

How Long do you Have to Retrain Payroll Records

Just in time for spring cleaning, the Social Security Administration and the IRS have issued a joint publication — the Spring 2015 issue of SSA/IRS Reporter — which offers valuable pointers for employers who want to clean up their old payroll files. In most (but not all) cases, that means following a four-year retention rule.

The Reporter cautions that failure to meet record retention requirements can result in sizable penalties and large settlement awards for employers that are unable to provide the required information when requested by the IRS or as part of an employment-related lawsuit. (Records could also be requested by state agencies.)

The Records-in-General Rule

As applied to employers that withhold and pay federal income, Social Security and Medicare taxes, the SSA/IRS Reporter says records relating to such taxes must be kept for at least four years after the due date of the employee’s personal income tax return (generally, April 15) for the year in which the payment was made.1

According to the SSA/IRS Reporter, these records include:

- The Employer Identification Number;

- Employees’ names, addresses, occupations and Social Security numbers;

- The total amounts and dates of payments of compensation and amounts withheld for taxes or otherwise, including reported tips and the fair market value of non-cash payments;

- The compensation amounts subject to withholding for federal income, Social Security and Medicare taxes, and the corresponding amounts withheld for each tax (and the date withheld if withholding occurred on a different day than the payment date);

- The pay period covered by each payment of compensation;

- Where applicable, the reason(s) why total compensation and taxable amount for each tax rate are different;

- The employee’s Form W-4, Employee’s Withholding Allowance Certificate;

- Each employee’s beginning and ending dates of employment;

- Statements provided by the employee reporting tips received;

- Fringe benefits provided to employees and any required substantiation;

- Adjustments or settlements of taxes; and

- Amounts and dates of tax deposits.

Employers should also follow the four-year retention rule for records relating to wage continuation payments made to employees by the employer or third party under an accident or health plan. Such records should include the beginning and ending dates of the period of absence, and the amount and weekly rate of each payment (including payments made by third parties). Employers also should keep copies of the employee’s Form W-4S, Request for Federal Income Tax Withholding From Sick Pay, and, where applicable, copies of Form 8922, Third-Party Sick Pay Recap.

A different rule applies for records substantiating any information returns and employer statements to employees regarding tip allocations. Under the tax code, these records must be kept for at least three years after the due date of the return or statement to which they relate.2

Claims for Refund of Withheld Tax

The SSA/IRS Reporter says employers that file a claim for refund, credit or abatement of withheld income and employment taxes must retain records related to the claim for at least four years after the filing date of the claim.

Fringe Benefit Records

The tax code provides an explicit record keeping requirement for employers with enumerated fringe benefit plans, such as health insurance, cafeteria, educational assistance, adoption assistance or dependent care assistance plan. They are required to keep whatever records are needed to determine whether the plan meets the requirements for excluding the benefit amounts from income.3

Note: Tax code provisions regarding fringe benefit records do not specify how long records pertaining to specified fringe benefits should be kept. Presumably, they are subject to the four-year rule under the records-in-general rule cited above, and thus should be kept at least four years after the due date of such tax for the return period to which the records relate or the date such tax is paid, whichever is later.

Caution: To the extent that any fringe benefit records must also comply with ERISA Title I, then a longer retention period of six years applies.4

Unemployment Tax Records

The Federal Unemployment Tax Act (FUTA) requires employers to retain records relating to compensation earned and unemployment contributions made. Under the records-in-general rule, such records must be retained for four years after the due date of the Form 940, Employer’s Annual Federal Unemployment Tax Return or the date the required FUTA tax was paid, whichever is later.

Records should be retained substantiating:

- The total amount of employee compensation paid during the calendar year;

- The amount of compensation subject to FUTA tax;

- State unemployment contributions made, with separate totals for amounts paid by the employer and amounts withheld from employees’ wages (currently, Alaska, New Jersey and Pennsylvania require employee contributions);

- All information shown on Form 940 (with Schedule A and/or R as applicable); and

- If applicable, the reason why total compensation and the taxable amounts are different.

The SSA/IRS Reporter reminds employers that record retention requirements are also set by the federal Department of Labor and state wage-hour and unemployment insurance agencies.

If you have additional questions, contact your payroll or tax adviser for guidance.

(Source: www.bizactions.com)

Time and Payroll

Time and Payroll

Time is relative, as explained by Albert Einstein. This holds true in both a scientific and metaphoric way of thinking. An entire day of fun can feel like it passes in just a few hours, whereas a few minutes in an English lecture can seem like hours, maybe even days if it is boring enough. We have all experienced some form of this, every time we say “I can’t believe its only 6 o’clock. It feels like it’s at least 9”. The best example of this happens when doing payroll. When in Daytona Beach payroll services is especially tough, because those two hours between now and leaving work for the beach can seem almost insurmountable. The work has to get done before payday though. If you run a company and do your own payroll, dealing with a new payday deadline every week, time becomes a relatively chaotic affair.

In a small company, it may be a bit less stressful, granted you don’t have a long list of employees to put on payroll. For someone running a larger company with more employees, that is when things get interesting. Not only do you have to keep it all on track, you also have to maintain and adjust it in case of mistakes. Employees may forget to clock in or out, and it’s up to you to catch them in time, or else their paycheck may come out drastically off. Then there is also the issue of keeping organized records for each pay period. When tax season comes around, the pressure can really start to grow.

When it is time for tax season, you have to keep up your payroll duties, while also preparing the proper tax documents. W-2s for the basic employees, 1099 forms for various other situations, such as subcontracted work, and getting it all distributed to the employees. There are federal deadlines to meet, which could incur consequences worse than dealing with an angry employee. Aside from the backlash of disgruntled employees, the company could face a fine of $250.00 for each W-2 not sent out by January 31st. There is no ceiling or limit to this consequence either; rather it will only end when each late W-2 has been fined. You can imagine how much of a toll this can take on your company’s finances.

Aside from all these consequences of fines and employees on the warpath, there is also the stress that accompanies the deadlines. Regardless of who an upset employee goes to, eventually it comes back to you. They may take their complaint straight to you, or to a manager who will carry the message to you. Either way, you don’t get to escape the sound of complaining. Be brave though, there may be a solution that will not only eliminate the stress of payroll deadlines, but also the payroll deadlines all together.

A growing trend in the modern business world is known as outsourcing. While the concept of outsourcing has been around for quite some time, recently it has begun to grow more and more popular. This means sending your payroll duties to another company, whose main priority is getting your payroll done on time. The best part that goes with this idea? Outsource companies such as Vision H.R., which helps supply places like Daytona Beach and Palm Coast with their payroll services, offers a free quote. You can get all the information you need to make the right decision for your company.

Save time, reduce stress, and take a few extra minutes out of your work schedule to sit back, and take in a deep breathe. Make that extra time seem all the more welcoming.

Daytona Beach Payroll Services

Vision HR | The Human Resource Experts

Core Vs. Non-Core Functions

Core Vs. Non-Core Functions

We all know that payroll is a vital component of any company. Without payroll, employees don’t get paid. When employees don’t get paid, work doesn’t get done, customers don’t get their product, dogs and cats start living together, mass hysteria and the entire business spirals into bankruptcy. So this of course means that payroll is a core function of a business. Least it would be if words were worked normally. Payroll is actually not a core function of a company. Why is it not a core function though? We saw the disorder that comes about without it, so shouldn’t it be a core function? No, because by definition, a core function of a company is a function that ensures a company’s profit.

This can include selling products, keeping a competitive edge, and general marketing. Non-core functions are functions that are not related to generating a profit. Just because they are considered a non-core function does not mean they are not essential processes. Unless you have a department whose only function is to stock the break room with donuts, every department of a company has some level of vital importance. Why is this definition important? because of outsourcing.

For the most part, you cannot outsource core functions. Imagine opening a store, then hiring another store to run your store. Non-core functions on the other hand, are great departments to consider for outsourcing. These can include payroll and human resource departments. They are both vital departments, especially since they relate to your employees and their productivity, yet are capable of being run by another company.

To better understand what a core and non-core function is, and how they work, let’s look at a painter.

The painter has to paint their own creation. The paint brush, the paint, the canvas, and the painter are all core functions of the method. Without them, the work will not get done at all. If he hires someone else to paint for him, then the one hired is the painter, not the one hiring him. Now think of the music playing in the background that many people use when creating. Maybe it is coming from your iPhone. You can turn it off, and have music play from your computer instead. It still is music, and it still is serving the purpose. What if you hire someone to play music while you paint? This means you outsourced your music playing requirements to someone else.

It may seem a bit odd to hire someone to play music while you paint, yet if you pay them 10 dollars an hour, and it takes you 3 hours to finish a $500.00 painting, then you are only spending $30.00 and are making $470.00. From that standpoint outsourcing your music needs is not such a bad idea.

A business is no different from the situation we just described. Only instead of painting a scene, a business is selling a product, with areas such as payroll and human resources taking the place of the music. With this example, you should have enough understanding of core and non-core systems to analysis what you could outsource and what needs to stay in house. If you would like some more information, or a free quote to see if outsourcing is right for you, contact Vision H.R. today. Supplying Daytona Beach, Palm Coast, and even Lake Mary Payroll Services, Vision H.R. has a highly traines staff ready to assist you.

Lake Mary Payroll Services

Vision HR | The Human Resource Experts

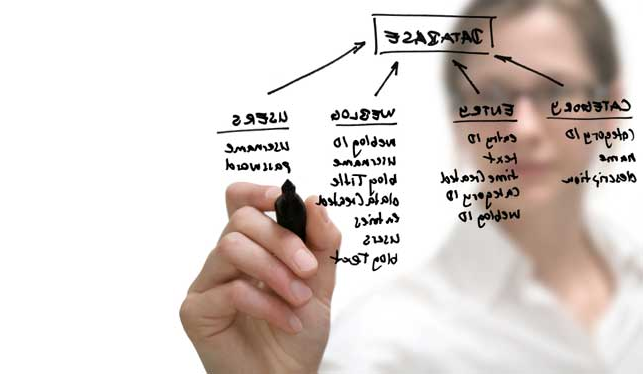

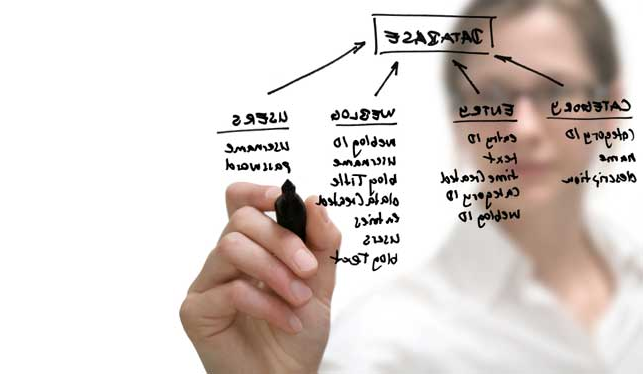

DATA

DATA

Da-ta: Noun: facts and statistics collected together for reference or analysis.

If atoms are the building blocks of the physical universe, then data would be the atoms of the business world. Without data, there is no modern business infrastructure. We don’t mean the data used to send funny cat photos to your friends, or the android from Star Trek either. We mean the raw data that is created and observed on a daily basis. Below we will show you a quick example of how data works.

Ten customers came into your store today and bought one Hershey’s candy bar each. That is data.

You made $10.00 total from these ten people. More data.

You paid $0.65 for each Hershey’s candy bar. Data

Studying the data so far, you spent $6.50 and made $10.00, resulting in a $3.50 profit, Which results in even more data.

With the data we just collected, we can tell that selling Hershey’s candy bars is a potentially profitable venture. Doing this each day will expand the data available for seeing if selling Hershey’s candy bars is a long term profitable idea. This example only gives a very small look at the overall type of overall data and statistics a company uses to succeed.

What does this all have to do with payroll though? Like we said before, data is the atoms of the business world. Being a part of the business world, payroll is no exception. Analyzing a company’s financial situation involves data from all departments, and payroll is one of the prominent ones. Minimum wage in Florida is $8.05, which means a minimum wage worker, working only 20 hours a week, will cost $644 for an average four week month. Most businesses don’t have just one employee, so payroll becomes a substantial component of a company’s finances.

With all this data, it may start getting a little confusing. You need organized data to really keep on track.One simple slip up, saving a report in the wrong folder for example, can complicate the entire process. When you are working on keeping track of all this information on your own, it can be like a daily tidal wave. If you own a small business that is still expanding, you may have no other choice. Least, you wouldn’t have a choice if not for companies such as Vision H.R. who are experts at maintaining payroll and all the numbers involved. When it comes to keeping track of information, you are less likely to make mistakes with the less you have to keep watch over. When you outsource your payroll, you get a regular, detailed report from Vision H.R. with all the information you need to analysis your finances and make informed decisions.

So why not put your payroll in good hands, get an unlimited data plan for your mobile phone, and let data work for you. With Vision H.R.’s free quote offer, you really have nothing to lose.

Payroll Services Titusville

Vision HR | The Human Resource Experts

Workers Compensation

Workers Compensation

Why do accidents happen in the workplace? many would be quick to say that it is because of negligence, or a simply unsafe working environment. A few would say that the worker is to blame for not following protocol. A extremely small few would say it is because of aliens. Well all but one of these are perfectly viable reasons why accidents happen, in reality a safe worker working in a safe environment is still at risk of injury. When you place “The Law of Truly Large Numbers”, (A law which states that enough trials, and even the most unlikely probability will eventually occur) into the work environment, it becomes evident that accidents happen in both unsafe and safe environments. This is why insurances such as Workers Compensation are important to have.

So what does Workers Compensation really do? More exact, what does Workers Compensation pay for? First and foremost, Workers Compensation pays for medical expenses related to the injury in question. This is different from basic medical insurance that a company may offer. Medical insurance is for general injuries and may include a co-pay. Workers Compensation doesn’t require any co-pay and is given regardless of your current insurance situation.

Secondary, it pays for lost wages due to the injury. Some minor injuries could have you back in the office the next day. If you are seriously injured and have to miss more than a week of work, what happens then? A broken leg isn’t going to stop the bills from coming in the mail. The amount of lost wages differs from person to person. Typically it is roughly 66% of an employee’s normal wage. For employees on salary, it is simple to figure out, since they get the same amount every pay period. For those working off wage, it would more likely be based off your average hours worked each week. It is important to have proper documentation of your weekly hours and pay scale. This will make deciding the amount to be paid move along with less obstacles.

If your injury prohibits you from returning to your previous position, and you have to enter a new position, workman’s compensation may pay for training or education as well.

If you are an employer, it is important to understand the way workman’s comp works. It may be easier for you to work with an outsourced company to set up your own workman’s compensation, or else one day you may find yourself paying far more for a lawsuit than you would be paying for the insurance. If you are in the Port Orange area, look at the possibility of contacting Vision H.R. to help handle not only your payroll, but also your workman’s compensation coverage.

Port Orange Group Benefits

Vision HR | The Human Resource Experts

Paid Vacation: Is it Worth It?

Paid Vacation: Is it Worth It?

When it comes to general labor, such as retail or fast food restaurants, new employment is a dime a dozen. Place a help wanted sign in the window and by the next day you will have a list of applicants to choose from. Although it is time you have to take away from your regular duties to hire someone new, it is not too hard to find someone to fit the position you need filled. What if your company’s needs are a little more precise? While anyone can be trained to run a cash register, what if you own a business building business websites, or own an accounting firm. The skill set required for this work is less common, and you may have to give a little to take a little.

This is where benefits such as paid vacation come into play. Offering benefits will help attract potential employees with the required skillsets to get the job done. Paid vacation is one that typically attracts both younger and more experienced candidates. It can be seen as a short-term benefit, usable when the individual desires it. benefits such as medical insurance are also attractive to candidates, but are not something they typically plan on using. Paid vacation though is a more flexible benefit. Not to mention, who doesn’t like getting paid to sleep in and enjoy a pants-optional day/lounge around day?

The question though, is it worth offering paid vacation? Will the gain outweigh the price? There is no legal restrictions on paid vacation, so you have some flexibility on how it is done. Some companies offer a full 40 hour work week worth of paid vacation per year. Others only offer one or two days. The first thing that you should consider is your own financial situation. You should have extra funds placed aside either for unexpected expenses, or for employee benefits. If not, see if there is room in your typical profit margin to afford them.

Another aspect to keep in mind is that vacation days are not a common thing. An employee in your company will not be off on paid time off every single week of the year. It is actually estimated in 2013 that 169 million vacation days were forfeited. That means 463,013 years of vacation time lost in 365 days. To really put that in perspective, with 169 million vacation days, you could watch the entire Netflix library an estimated 42,000 times! That is a lot of CSI Miami reruns.

What happens when an employee doesn’t take their vacation time? This is another thing that should be considered, and luckily is also a flexible area for you to work with. Some companies will allow the employee to cash them out. Some allow their employees vacation time to roll over. Other’s simply end the employee’s vacation time and restarts the count, meaning if they had five days, and only used two, at the end of the period the remaining three would be lost and the employee would again have five vacation days. Some companies allow the vacation time to build until retirement, and pay it in either one large sum, or regular payments to the person.

Is your company capable of offering it’s employees paid vacation? Work with a payroll professional like the ones found at Vision H.R. and see how one can fit into your own payroll. Vision H.R. has highly trained individuals ready to analysis and create a payroll that works for you, with the added benefits you wish to offer to your employees. So pick up the phone today, after all, you may want to enjoy some paid time off as well.

Employee Benefits Daytona

Vision HR | The Human Resource Experts